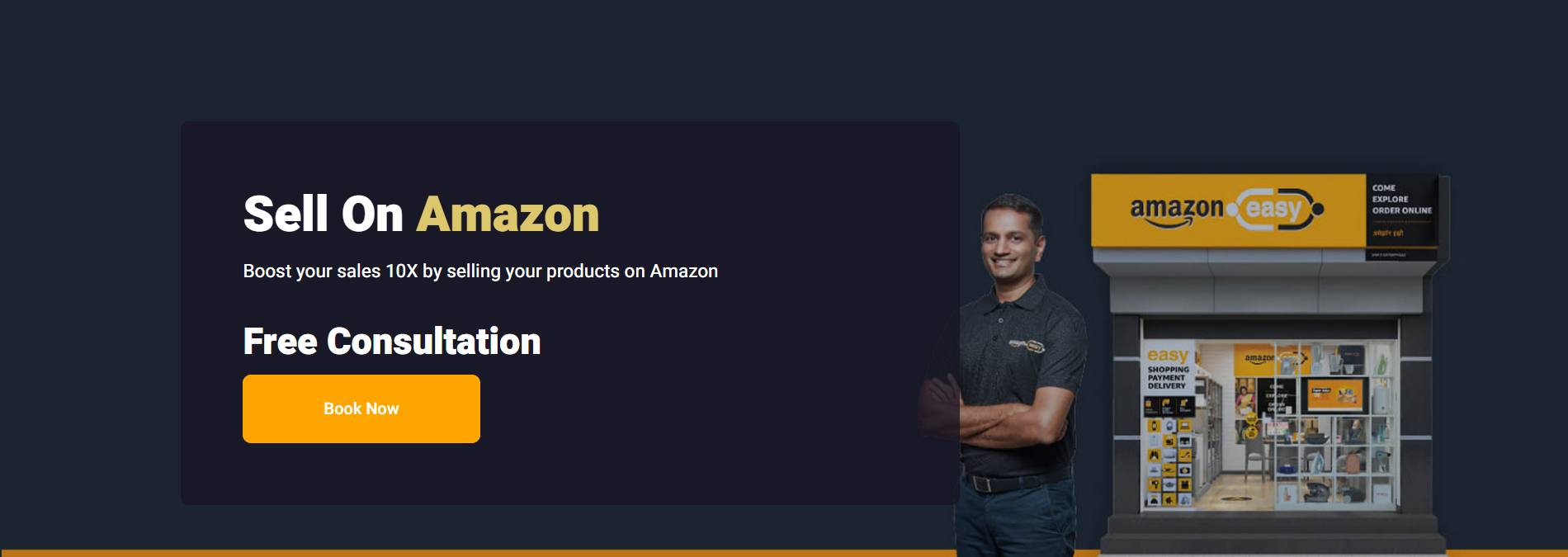

- Sell on Amazon

Who Can Become Amazon Seller?

Amazon is the most popular global online store which connects sellers and buyers on its platform which works on the B2C model. Anyone can become Amazon Seller who deals in manufacturing or retailing and wants to sell at Amazon. Jeff Bezos founds Amazon changes the way of shopping experience across the globe.

Seller Seva